Obviously, such laws on hindsight look very undemocratic and politically suicidal; but then, if one were to explore it and go beneath the surface, the big picture may gradually get vivider. In tough economic times, gold and similar forms of monetary elements can become a key source of increasing money flow in the market. One should remember that most nations (including ours) have at one time or the other even printed money based on the amount of gold kept in the federal bank (Reserve Bank of India, in the case of India). In other words, hoarding of gold by communities, corporations and individuals not only decreases the flow of money (given the unproductive capital locked within such hoarded gold) but also to a large extent disturbs the supply-demand equilibrium of gold and bullion. Before I reach India, let me in brief discuss the way Uncle Sam tapped (or as many critics would say, exploited) the Executive Order No 6102. The order forced every American citizen to surrender all their gold, leave 160 gms, to the Federal Reserve in exchange of a fixed amount of money. After receiving most of the gold, the US government increased gold prices manifold, thus churning out a huge amount of profit, which was used for the Exchange Stabilization Fund (ESF), a fund that enables the American government to control currency exchange rates. In 1964, the previous laws were modified and the ownership of ‘gold certificates’ was legalized, followed by the legalising of gold trade in 1974 – after almost three and a half decades.

The importance of and aspiration for gold ownership in India requires no introduction. Despite economic turmoil, the consumer demand for gold is up by 51 per cent in Q2 2013 while the demand for gold bars and coins is up by 116 per cent. As per various unofficial estimates, more than 60,000 tonnes of gold are lying idle in the form of jewellery and ornaments all across the nation. Going by the current price of gold at the rate of Rs.35,000 for ten grams, this unaccounted reserves could create a possibility of reaping about Rs.2,10,00,000 crores in money supply! Going by World Gold Council figures, Indians hold 20,000 tonnes of gold (which is an absurdly less figure, as a single temple in South India holds more than 1000 tonnes of gold); even considering this reduced figure of 20,000 tonnes (which is 33% of the unofficial estimates), the amount we’re talking about would be nothing less than Rs.70,00,000 crores!

Against these jaw-dropping numbers, what looks hilariously minuscule is the state of RBI. Despite such huge national deposits of gold, RBI has an official reserve of a mere 550 tonnes of gold, compared to 1000 tonnes of China (which is again debatable) and 9000 tonnes of US.

The Government of India should immediately draft and announce a Central Gold Bond scheme, where it should ask people to deposit their gold with the government in lieu of Central Gold bonds at a fixed rate of interest of around 9%. One reason I mention this percentage is because in my calculations, I have realised that despite the huge surge in gold price, in the last 65 years the same has increased by only around 9% per annum compounded. With respect to the government’s gold bond scheme, people should of course be allowed to take back their gold after say a period of 15 years. The same will be applicable for temples, trusts and other similar institutions; for them, the government could even make it compulsory to deposit all gold and make hoarding beyond a limit illegal. These institutions should be thankful that the government is not nationalizing their gold hoardings, given the immense employment generation potential this money can have. Thus, a huge percentage of gold in physical form would be directed to the Reserve Bank, which, in turn, would utilise the same to increase the money flow and to adjust the exchange rates of our currency. Similar schemes have been in the past practiced by many European and African nations, with the latest being Venezuela. Read More....

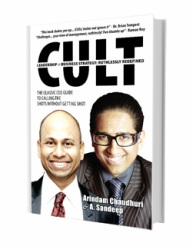

An Initiative of IIPM, Malay Chaudhuri and Arindam Chaudhuri (Renowned Management Guru and Economist).

For More IIPM Info, Visit below mentioned IIPM articles

SC slams AICTE's illicit control on MBA courses

MBA, MCA courses no longer under AICTE

2012 : DNA National B-School Survey 2012

Ranked 1st in International Exposure (ahead of all the IIMs)

Ranked 6th Overall

Zee Business Best B-School Survey 2012

Prof. Arindam Chaudhuri’s Session at IMA Indore

IIPM IN FINANCIAL TIMES, UK. FEATURE OF THE WEEK

IIPM strong hold on Placement : 10000 Students Placed in last 5 year

IIPM’s Management Consulting Arm-Planman Consulting

Professor Arindam Chaudhuri – A Man For The Society….

IIPM: Indian Institute of Planning and Management

IIPM makes business education truly global

Management Guru Arindam Chaudhuri

Rajita Chaudhuri-The New Age Woman

IIPM B-School Facebook Page

IIPM Global Exposure

IIPM Best B School India

IIPM B-School Detail

IIPM Links

IIPM : The B-School with a Human Face

------------------------------------------------------------------------

RSS Feed

RSS Feed