If things go right, then the entry of foreign firms in the long run should benefit the overall economy by subsuming farmers, producers of finished goods, creating mass scale employment, increasing government revenue and hopefully cleansing the muck that lies in our storage and distribution. If all falls into place, then organized retail market is then expected to reach approximately $260 billion by 2020. It would augment income levels of all stakeholders to the tune of $35-45 billion a year, new employment generation to the tune of 3-4 million directly and 4-6 million indirectly. With foreign multinationals setting up shop across the country, the government exchequer would likely bloat up by $25-30 billion per year. The Small and Medium Enterprises (SMEs) are likely to prosper too and learn the concepts of enhanced production, higher productivity, assured supply, quick payment and better quality. It will further boost the organized sector growth – a sector that is already growing at an impressive 24 per cent in the last 3 years. The retail sector would also increase the farmers’ income – who at the current stage are on the threshold of marginal living at best or on the verge of committing suicides at the worst. So, of course, it is inevitable for India to allow FDI in retail and the writing on the wall is also very clear. But amongst all this, almost everyone is missing out one moot question, which is fundamental to the success of the Indian retail story.

Amongst other clauses that the government has put, one interesting clause is that these large retailers have to essentially source their supplies from the small and medium enterprises to the tune of 30 percent. But then, this is a universal clause and does not essentially mean that it is the Indian SME segment that is going to benefit from the same. And this is where we have our biggest threat. The question is: would Indians take pride to pick up Indian brands from these stores? The bigger question is: do we have enough Indian brands which can stock the shelves of these monstrous giant outlets? In fact the entire debate of organized retail short-changing the farmers and producers is all baseless, simply because retail survives finally on what sells. And if Indian producers and manufacturers are able to produce brands which are in demand, then they definitely would get shelf space. It is no secret that more than 60 per cent of what Walmart sells in the US is sourced from China. The same holds true for the Tescos and the Carrefours of the world.

The British always prefer home-grown apples over imported ones, especially the Cox variety; and thus the retailers are seen selling the domestic varieties more than the imported varieties. In order to avoid mass resistance, it is general practice that many luxury brands take their goods for finishing to their home nation and then tag the product as a domestic output. In this light, a survey by Harrison Group showed that around 65 per cent of rich American consumers buy ‘domestically made’ products whenever possible. Japanese too prefer the products to be finally processed at local units than to be imported finished goods. This is true for most of the east-Asian nations. To some extent, American companies such as GM and Chrysler were bailed out because they represented Americanism – evident from the way these are used in American movies – of course, apart from other economic reasons. As recent as in August 2011, the South Korean tobacco association campaigned against Japanese products; and in October, Iranian Ayatollah Ali Khamenei asked the government to purchase only domestically produced goods and requested the President to ban foreign items in the nation if the same were being produced by local companies.

In fact, with respect to national pride, the best case in point is South Korea. It’s perhaps the country I appreciate the most throughout the world; more than China, more than Japan.When compared to India, it is a dot of a nation, but thanks to their sense of national pride, they have made unprecedented strides in all sectors. South Korean schools promote usage of local-brand purchases among students and a criticism to this is perceived as criticism to the nation. In spite of worldwide success, Nokia and Blackberry are still not able to gain substantial market-share in South Korea and Samsung Electronics dominates the market with over 48 per cent market share. In fact, the Republic of Samsung (as it is popularly called) touches almost every aspect of life in South Korea. Google has merely 20 per cent market share in South Korea while domestic search engines namely Naver and Daum dominate 90 per cent market share. In automobiles, the top car brands are either from Kia or Hyundai or SsangYong, which out-compete the BMWs and Mercs of the world. On the roads of Seoul, spotting an American or a Japanese car is a total rarity – and I am saying this from the personal experience of trying to estimate the ratio! It’s not that the Korean cars look bad or are of bad quality. They look stunning and each one is better than the other. So the fact is that consumers don’t buy their national products by sacrificing quality. The government policies were such that the local manufacturers were given all the support and a very competitive environment to improve quality by competing locally – unlike in India where we opened up our markets like cheats allowing the legacy Ambassadors to compete against the snazzy then post-modern Hondas. It was similar to allowing players to compete in the Olympics without having held good quality national games to nurture talent. Read More....

For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

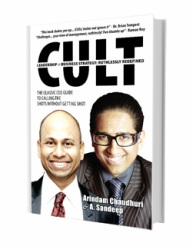

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website

IIPM Proves Its Mettle Once Again....

Planman Technologies

IIPM Contact Info

IIPM History

IIPM Think Tank

IIPM Infrastructure

IIPM Info

IIPM: Selection Process

IIPM: Research and Publications

IIPM MBA Institute India

-----------------------------------------------------------------------

RSS Feed

RSS Feed