Many may not be aware, especially in our part of the world, that back in the year 1933, on April 5, US President Franklin D Roosevelt signed one of the most controversial orders in American economic history. The Executive Order No. 6102 criminalized the possession of gold by individuals and corporations and forbid “the hoarding of gold coins, gold bullion, and gold certificates within the continental United States.” This order was an extension of the Presidential Proclamation No. 2039 that criminalized the hoarding, possession and ownership of gold or bullion, and imposed a monetary penalty of $10,000 (equal to more $170,000 in today’s value) and imprisonment for as long as ten years on individuals falling foul of the law. Obviously, such laws on hindsight look very undemocratic and politically suicidal; but then, if one were to explore it and go beneath the surface, the big picture may gradually get vivider. In tough economic times, gold and similar forms of monetary elements can become a key source of increasing money flow in the market. One should remember that most nations (including ours) have at one time or the other even printed money based on the amount of gold kept in the federal bank (Reserve Bank of India, in the case of India). In other words, hoarding of gold by communities, corporations and individuals not only decreases the flow of money (given the unproductive capital locked within such hoarded gold) but also to a large extent disturbs the supply-demand equilibrium of gold and bullion. Before I reach India, let me in brief discuss the way Uncle Sam tapped (or as many critics would say, exploited) the Executive Order No 6102. The order forced every American citizen to surrender all their gold, leave 160 gms, to the Federal Reserve in exchange of a fixed amount of money. After receiving most of the gold, the US government increased gold prices manifold, thus churning out a huge amount of profit, which was used for the Exchange Stabilization Fund (ESF), a fund that enables the American government to control currency exchange rates. In 1964, the previous laws were modified and the ownership of ‘gold certificates’ was legalized, followed by the legalising of gold trade in 1974 – after almost three and a half decades. The importance of and aspiration for gold ownership in India requires no introduction. Despite economic turmoil, the consumer demand for gold is up by 51 per cent in Q2 2013 while the demand for gold bars and coins is up by 116 per cent. As per various unofficial estimates, more than 60,000 tonnes of gold are lying idle in the form of jewellery and ornaments all across the nation. Going by the current price of gold at the rate of Rs.35,000 for ten grams, this unaccounted reserves could create a possibility of reaping about Rs.2,10,00,000 crores in money supply! Going by World Gold Council figures, Indians hold 20,000 tonnes of gold (which is an absurdly less figure, as a single temple in South India holds more than 1000 tonnes of gold); even considering this reduced figure of 20,000 tonnes (which is 33% of the unofficial estimates), the amount we’re talking about would be nothing less than Rs.70,00,000 crores! Against these jaw-dropping numbers, what looks hilariously minuscule is the state of RBI. Despite such huge national deposits of gold, RBI has an official reserve of a mere 550 tonnes of gold, compared to 1000 tonnes of China (which is again debatable) and 9000 tonnes of US. The Government of India should immediately draft and announce a Central Gold Bond scheme, where it should ask people to deposit their gold with the government in lieu of Central Gold bonds at a fixed rate of interest of around 9%. One reason I mention this percentage is because in my calculations, I have realised that despite the huge surge in gold price, in the last 65 years the same has increased by only around 9% per annum compounded. With respect to the government’s gold bond scheme, people should of course be allowed to take back their gold after say a period of 15 years. The same will be applicable for temples, trusts and other similar institutions; for them, the government could even make it compulsory to deposit all gold and make hoarding beyond a limit illegal. These institutions should be thankful that the government is not nationalizing their gold hoardings, given the immense employment generation potential this money can have. Thus, a huge percentage of gold in physical form would be directed to the Reserve Bank, which, in turn, would utilise the same to increase the money flow and to adjust the exchange rates of our currency. Similar schemes have been in the past practiced by many European and African nations, with the latest being Venezuela. Read More....An Initiative of IIPM, Malay Chaudhuri and Arindam Chaudhuri ( Renowned Management Guru and Economist). For More IIPM Info, Visit below mentioned IIPM articles SC slams AICTE's illicit control on MBA coursesMBA, MCA courses no longer under AICTE 2012 : DNA National B-School Survey 2012

Ranked 1st in International Exposure (ahead of all the IIMs)

Ranked 6th OverallZee Business Best B-School Survey 2012 Prof. Arindam Chaudhuri’s Session at IMA IndoreIIPM IN FINANCIAL TIMES, UK. FEATURE OF THE WEEK IIPM strong hold on Placement : 10000 Students Placed in last 5 yearIIPM’s Management Consulting Arm-Planman ConsultingProfessor Arindam Chaudhuri – A Man For The Society….IIPM: Indian Institute of Planning and ManagementIIPM makes business education truly global

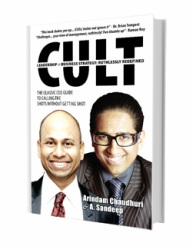

Management Guru Arindam Chaudhuri

Rajita Chaudhuri-The New Age Woman

IIPM B-School Facebook Page

IIPM Global Exposure

IIPM Best B School India

IIPM B-School Detail IIPM LinksIIPM : The B-School with a Human Face------------------------------------------------------------------------

Unlike T. N. Seshan, when you meet Vinod Rai, the current Comptroller and Auditor General of India, he comes across as a very suave and soft-spoken bureaucrat. At the recent convocation ceremony of our graduating students, when our institute’s Director Dr. M. K. Chaudhuri challenges Vinod Rai and says that he isn’t bold enough like Mr. Seshan and is not as strongly taking the government head-on as he should, he very firmly says that he is doing what he is constitutionally allowed to do. So what does Vinod Rai have to say about Pranab Mukherjee’s public snub that 90% of CAG findings are dropped in the first stage? “Yes, Mr. Mukherjee is right in some sense. CAG raises questions and it’s true that a large proportion of issues do get answered to our satisfaction in the very first stage,” he says very politely, yet very firmly; and at no point in any self-doubt about whether he was doing less than he should be. Does this sound slightly lame? Perhaps. Specially because, being slightly aggressive about such issues myself, I might have personally liked Vinod Rai to stretch his constitutional limits slightly more, redefine them, and take the government head-on perhaps more loudly. But then all human beings don’t have the same approach to dealing with identical issues. Our current election commissioner Dr. S. Y. Quraishi is a very soft-spoken, music loving man; but he is the man behind bringing democracy to the killing fields of Bihar, Bengal and UP! Similarly, Vinod Rai is a man who again is soft-spoken, abhorring the limelight, but doing his work with amazing sincerity, courage and commitment. Similar to what T. N. Seshan did with the Election Commission, Rai has made CAG a household name in India and a body that Indians are now looking up to with respect to exposing our government’s corrupt practices! Today, our government fears his reports like nothing else, for in these days of heightened social activism and rampant corruption, those are CAG reports that are giving the maximum ammunition to critics of the government. So what is the CAG authority doing and why is its role so important? Well, CAG is bringing to public the sham and the shame behind India’s Blood Billionaires – the saga of corruption and transfer of national wealth into private hands at the cost of the tax payers’ money and the country’s national interests. What exactly do I mean? Well, the annual Forbes billionaires’ list now regularly features a significant number of Indian businessmen (almost 30 plus) with an accumulated worth that’s a staggering USD 200 billion plus (almost 15% of what the entire Indian population earns in a year). In fact, of these billionaires, three of the names also appear regularly in the top 20 of the global rich! The only other economy that outscores India still on these parameters is USA, which still has one or two more billionaires in the said list. Today, India is the only Asian economy to have so many billionaires in that list; next to it is Japan, with a history of many years of stupendous national development! How did this awesome Indian miracle happen? When I go abroad, this intrigues everyone! They are amazed that while billionaires like Bill Gates, Warren Buffett and others have made their fortunes after years of investing in brand building, R&D and by painstakingly focusing on capturing international markets, we have managed so many billionaires without having any brand in the international markets. Look at the BusinessWeek-Interbrand survey of the world’s 100 top brands – not one is Indian. That kind of explains the story. While the Japanese, French, Swiss, Germans, Italians and the likes get beaten hands down in the billionaires’ lists by Indians, they are the ones who dominate the top brands’ lists... and of course, not to forget the Americans, who spent a hundred years competing in the global markets, creating brands, investing massively in R&D, losing out to competition, fighting back again, and finally creating wealth and billionaires. Then how are the Indians dominating the various lists of global billionaires? The answer is quite simple actually – Indians are there right at the top within these lists purely through scams, loot and the criminal transfer of national wealth into private hands… consequently ensuring mindboggling market capitalisation for their companies and the billionaire status for them; and all this without churning out a ‘single’ global brand or product! Yes, that’s the truth!!! After Independence, our industrialists were given a monopoly market to operate in, thanks to the bureaucratic system of bribery-driven work culture we created. Over the years, the private sector industrialists were further helped by the government (after more quid pro quo greasing of palms by these industrialists) in amassing additional wealth and profits by allowing them to buy public sector products – like, say, steel – at subsidised prices, while these very private companies sold the finished products – like, say, buses and tractors – in the markets at the market price. Thus, real and potential profits and wealth of the PSUs were transferred to private sector balance sheets without flinching; and at the same time, PSUs were branded loss-making failures! This was the first phase of growth for our Indian business houses, giving rise to monopolies and fraudulent rupee billionaires. Since this first experiment kept us a third world and third class country, the second phase of growth started post liberalisation.

Read More....For More IIPM Info, Visit below mentioned IIPM articles.

IIPM B-School Detail

IIPM makes business education truly global

IIPM’s Management Consulting Arm - Planman Consulting

Arindam Chaudhuri (IIPM Dean) – ‘Every human being is a diamond’

IIPM ranked No 1 B-School in India

domain-b.com : IIPM ranked ahead of IIMs

IIPM: Management Education India

Prof. Rajita Chaudhuri's Website-----------------------------------------------------------------------------------------------------------------------------

|

RSS Feed

RSS Feed